Financing Options

Flexible Payment Terms Available

CIS offers financing on new and refurbished equipment.

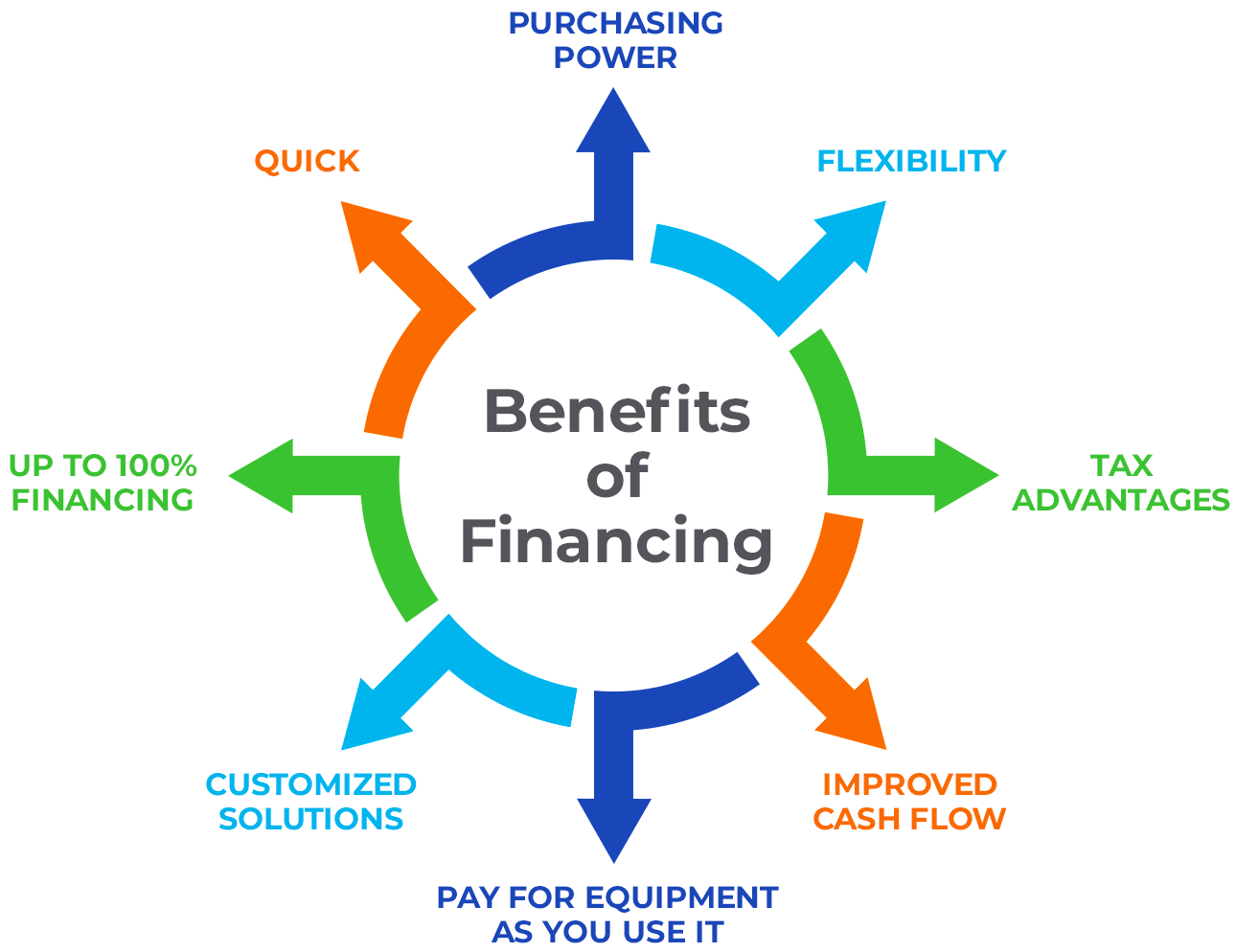

Benefits of Financing

- Purchasing power

- Flexibility

- Tax advantages

- Pay for equipment as you use it

- Improved cash flow

- Customized solutions

- Up To 100% Financing

- Quick

Learn more by contacting:

VGM Financial Services

Chad Hamann

[email protected]

800-532-4656

www.vgmfs.com

Umpqua Bank

Adam Breene

[email protected]

303-482-1846

umpquabank.com